|

|

| Article Details |

|

|

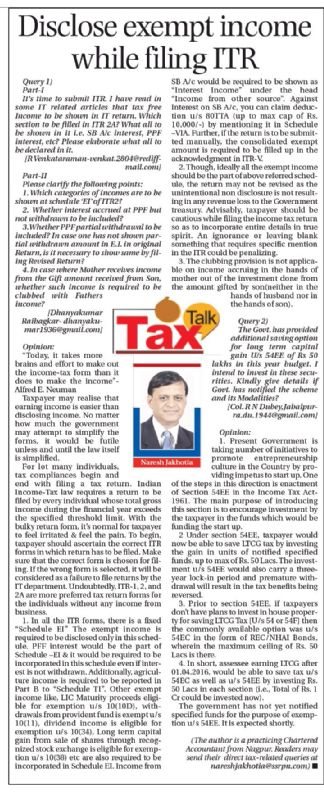

Disclose exempt income while filing ITR |

eTAX TALK-04.07.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Disclose exempt income while filing ITR

Query 1]

Part-I]

It's time to submit ITR. I have read in some IT related articles that tax free Income to be shown in IT return. Which section to be filled in ITR 2A? What all to be shown in it i.e. SB A/c interest, PPF interest, etc? Please elaborate what all to be declared in it. [R Venkataraman-venkat.2804@rediffmail.com]

Part-II]

Please clarify the following points:

1. Which categories of incomes are to be shown at schedule ‘EI’ of ITR2?

2. Whether interest accrued at PPF but not withdrawn to be included?

3. Whether PPF partial withdrawal to be included? In case one has not shown partial withdrawn amount in E.I. in original Return, is it necessary to show same by filing Revised Return?

4. In case where Mother receives income from the Gift amount received from Son, whether such income is required to be clubbed with Fathers income? [Dhanyakumar Raibagkar- dhanyakumar1936@gmail.com]

Opinion:

“Today, it takes more brains and effort to make out the income-tax form than it does to make the income”- Alfred E. Neuman

Taxpayer may realize that earning income is easier than disclosing income. No matter how much the government may attempt to simplify the forms, it would be futile unless and until the law itself is simplified.

For lot many individuals, tax compliances begin and end with filing a tax return. Indian Income-Tax law requires a return to be filed by every individual whose total gross income during the financial year exceeds the specified threshold limit. With the bulky return form, it’s normal for taxpayer to feel irritated & feel the pain. To begin, taxpayer should ascertain the correct ITR forms in which return has to be filed. Make sure that the correct form is chosen for filing. If the wrong form is selected, it will be considered as a failure to file returns by the IT department. Undoubtedly, ITR-1, 2, & 2A are more preferred tax return forms for the individuals without any income from business.

- In all the ITR forms, there is a fixed “Schedule EI” The exempt income is required to be disclosed only in this schedule. PFF interest would be the part of Schedule –EI & it would be required to be incorporated in this schedule even if interest is not withdrawn. Additionally, agriculture income is required to be reported in Part B to “Schedule TI”. Other exempt income like, LIC Maturity proceeds eligible for exemption u/s 10(10D), withdrawals from provident fund is exempt u/s 10(11), dividend income is eligible for exemption u/s 10(34), Long term capital gain from sale of shares through recognized stock exchange is eligible for exemption u/s 10(38) etc are also required to be incorporated in Schedule EI. Income from SB A/c would be required to be shown as “Interest Income” under the head “Income from other source”. Against Interest on SB A/c, you can claim deduction u/s 80TTA (up to max cap of Rs. 10,000/-) by mentioning it in Schedule –VIA. Further, if the return is to be submitted manually, the consolidated exempt amount is required to be filled up in the acknowledgment in ITR-V.

- Though, ideally all the exempt income should be the part of above referred schedule, the return may not be revised as the unintentional non disclosure is not resulting in any revenue loss to the Government treasury. Advisably, taxpayer should be cautious while filing the income tax return so as to incorporate entire details in true spirit. An ignorance or leaving blank something that requires specific mention in the ITR could be penalizing.

- The clubbing provision is not applicable on income accruing in the hands of mother out of the investment done from the amount gifted by son(neither in the hands of husband nor in the hands of son).

Query 2]

The Govt. has provided additional saving option for long term capital gain U/s 54EE of Rs 50 lakhs in this year budget. I intend to invest in these securities. Kindly give details if Govt. has notified the scheme and its Modalities? [Col. R N Dubey,Jabalpur-ra.du.1944@gmail.com]

Opinion:

1. Present Government is taking number of initiatives to promote entrepreneurship culture in the Country by providing impetus to start up. One of the steps in this direction is enactment of Section 54EE in the Income Tax Act-1961. The main purpose of introducing this section is to encourage investment by the taxpayer in the funds which would be funding the start up.

2. Under section 54EE, taxpayer would now be able to save LTCG tax by investing the gain in units of notified specified funds, up to max of Rs. 50 Lacs. The investment u/s 54EE would also carry a three-year lock-in period and premature withdrawal will result in the tax benefits being reversed.

3. Prior to section 54EE, if taxpayers don’t have plans to invest in house property for saving LTCG Tax [U/s 54 or 54F] then the commonly available option was u/s 54EC in the form of REC/NHAI Bonds, wherein the maximum ceiling of Rs. 50 Lacs is there.

4. In short, assessee earning LTCG after 01.04.2016, would be able to save tax u/s 54EC as well as u/s 54EE by investing Rs. 50 Lacs in each section (i.e., Total of Rs. 1 Cr could be invested now).

The government has not yet notified specified funds for the purpose of exemption u/s 54EE. It is expected shortly.

[The author is a practicing Chartered Accountant from Nagpur. Readers may send their direct tax related queries at

SSRPN & Co

10, Laxmi Vyankatesh Apartment

C.A. Road, Telephone Exch. Square

Nagpur-440008

or email it at nareshjakhotia@ssrpn.com]

|

|

|

|

|

| |

|

|

|

|

|

.png)