Article Details

| Income tax department acting tough against the Non filers |

|

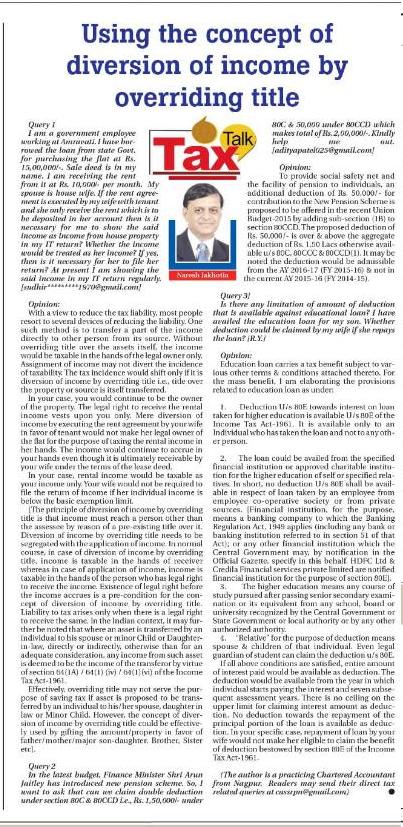

TAX TALK-11.01.2016-THE HITAVADA TAX TALK CA. NARESH JAKHOTIA Chartered AccountantIncome tax department acting tough against the Non filers Query 1] I have following queries:

You don't pay Taxes - They take Taxes - Chris Rock 1. Gone are the days when the non filers with tax liability could go unnoticed. With income tax department is getting fully hi-tech and utilizing the technology effectively, there is always a third eye of income tax department on the taxpayer. Income Tax Department is acting tough with the tax evaders & non-filers. The chances of non filers going scot free are rare now. The Income Tax department has identified over 44 lakh high-value spenders in the country who have not filed their returns till now. The department is now extracting the information from multiple sources about multiple transactions. Non filing of the return for the person with income above basic exemption limit would attract heavy penalty, fine and prosecution also. The department is keeping a hawk’s eye on income, expense, fund flow and investment details of the taxpayers. Below are some of the transactions/ information collected by the department through AIR, CIB and TDS returns. Through Annual Information Return(AIR): Cash deposits aggregating to Rs. 10,00,000/- or more in a year in any savings account, Payment of Rs. 2,00,000/- or more against credit card bills, Investment of Rs. 2,00,000 or more in Mutual Fund or Rs. 5,00,000/- or more in Bonds or Debenture or Rs. 1,00,000/- or more for acquiring shares or RBI Bond of Rs. 5,00,000/- or more, Purchase of Immovable Property valued at Rs. 30,00,000/- or more. Through Central Information Branch (CIB): Sale of Motor Vehicle, Transfer of immovable property or capital assets where value declared for the purpose of stamp duty is more than actual sale value, Purchase of Immovable property valued at Rs. 5 lakhs or more, FDR of Rs 1,00,000/ or more, Purchase of Bank Draft of more than Rs. 50,000/- in cash, Share Transactions more than Rs. 20,000/-, CIB-410: Cash deposit aggregating of Rs 2,00,000/- on a day, Interest paid by co operative credit Society. Through TDS return: Where TDS is done by the payer but the payee has not filed the return or not shown it in the return. It’s time for the non filers to be very cautious. If the income of any individual is above the basic exemption limit, file the return within time. Else, be prepared for a warm hug through notices, fine, penalties and prosecution. 2. Proprietary firm don’t have any independent & separate status under the Income Tax Act-1961. Only one return is required to be filed by your friend wherein all the income (Income from his proprietary firm as well as income earned in individual capacity) is required to be incorporated. 3. Deduction u/s 80C is also available towards the payment of the tuition fees, subject to the overall cap of Rs. 1.50 Lacs. However, it is admissible only against the payment of tuition fees to university, college or school or other educational institutions situated within India for the purpose of full time education of any two children of the individual. It may be noted that only tuition fees is eligible for deduction and no deduction is available towards the payment of development fee, donation or payment of similar nature. Query 2] I'm in Govt. service (Army). I had three properties till Sept-2015 at Nasik, Pune and Bhopal. Though small, flats were purchased to reduce tax burden over the years. The detail of the transactions is as under: 1. Nasik House is a self occupied, purchased in 2007. No loan outstanding at present. 2. Pune House is at in Fatima Nagar. It was purchased in May-2012 for Rs. 20 Lacs. It was a 28 yrs old property. Now, consideration value is about Rs. 28 to 29 lacs. Loan cleared in the last year. It was sold in Sept-2015 for Rs. 29.50 lacs. How much is my capital gain? I think- Nil. Please let me know capital gain after indexation table of this year. 3. Bhopal House was purchased in March-2014. Rented out and the annual let out value is about Rs. 60,000/-. Total interest component was about Rs. 2.85 Lacs. EMI Rs. 40,000/- plus. I’ve paid Rs. 20 Lacs out of the sale proceeds of pune flat to reduce the principle amount in Sept-2015. 4. Actual plan was to sell off pune property and buy third/second at Bhopal but due to lower prevailing price as well as the holding period being less than 3 years, could not sell off in 2014 as it might have been treated as STCG. So decision was delayed to this year. My query: Since 3 years completed in May-2015 for pune property, I sold the property of pune in Sept-2015. In a classical sense, as per rules to avoid the LTCG tax, one needs to sell the property first and then invest in other. However, in this case I purchased the third property almost one year prior but used the sale proceeds to reduce the EMI after the sale this year. What will be my tax liabilty for FY 2015 -2016 as a result of sale of Pune property? Please confirm. [S.B.Deshpande- svdeshu@hotmail.com] Opinion: 1. Computing Long Term Capital Gain (LTCG) on sale of Pune Flat: Cost Inflation Index (CII) for FY 2012-13 (year of flat purchase) was “852” & your purchase price was Rs. 20 Lacs. You can further add the stamp duty, registration fees & other expenses incurred while purchasing the flat to arrive at the cost of acquisition. Ignoring stamp duty etc, your indexed cost of acquisition would be Rs. 25.37 Lacs (Rs. 20 Lacs*1081/852). Your sale price is Rs. 29.50 Lacs and if it is higher than the stamp duty valuation of the property, then Long Term Capital Gain (LTCG) would be Rs. 4.12 Lacs (Rs. 29.50 Lacs Cr less Rs. 25.37 Lacs). However, if stamp duty valuation is more than Rs. 29.50 Lacs, the LTCG would be required to be computed by taking such higher value as sale consideration. LTCG is taxable at a special rate of 20% plus education cess. In short, your additional tax liability as a result of LTCG on the basis of above calculation would be Rs. 84,963/-. 2. Tax saving Options: Individuals can save LTCG tax by exercising any of the following tax saving options: i) Exemption Under Section 54: For exemption u/s 54, individual have to invests the amount of LTCG for purchase or construction of another residential house property within a prescribed time period. The prescribed time periods are as under: a] For purchase: One year before or two years from the date of sale. b] For Constructions: Three years from the date of sale. ii) Exemption Under Section 54EC: To save tax u/s 54EC, taxpayers have to invest the amount of LTCG in the Specified bonds issued by Rural Electrification Corporation (REC) or National Highway Authority of India ( NHAI) within a period of 6 months from the date of sale. 3. In your specific case, you have purchased the Bhopal Flat in March-2014 whereas you have sold the Pune Flat in Septeber-2015. Since the Bhopal Flat was purchased by you prior to one year, you would not be eligible for LTCG exemption u/s 54 even though the end use of the sale proceeds is towards Bhopal Flat (i.e., repayment of the loan taken for purchase of Bhopal Flat). 4. You have an option to claim an exemption U/s 54EC by investing the amount of LTCG (i.e., Rs. 4.12 Lacs) in the specified bonds issued by NHAI/REC. SSRPN & Co 10, Laxmi Vyankatesh Apartment C.A. Road, Telephone Exch. Square Nagpur-440008 or email it at nareshjakhotia@ssrpn.comI |

|

.png)