My Articles

| Interest on compensation on acquisition of land: Tax Complexity |

|

TAX TALK-30.10.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Section 145A(b) provides that inter...

Continue Reading... |

|

| Taxation of F & O transactions |

|

TAX TALK-23.10.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

The most crucial point arises with ...

Continue Reading... |

|

| Belated filed return can also be revised now |

|

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Error in income tax return forms can be corrected by filing a revis...

Continue Reading... |

|

| Merger, Demerger & Amalgamation- Tax implications on shareholder |

|

TAX TALK-09.10.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

There is a tax conces...

Continue Reading... |

|

| An additional compliance of submitting estimated current Income & Advance tax payment |

|

TAX TALK-02.10..2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Proposed amendment r...

Continue Reading... |

|

| Change in the base year from 1981 to 2001 is for all classes of assets |

|

TAX TALK-02.10..2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

The change in the base...

Continue Reading... |

|

| Even small size firm are to get its accounts audited if income offered for taxation is less than 8% |

|

TAX TALK-18.10.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Amendment so ...

Continue Reading... |

|

| NRI & taxation of mutual fund investments |

|

NRI & taxation of mutual fund investments

Query 1]

My daughter purchased shares of Persistent Systems Ltd in 2009. She became NRI since ...

Continue Reading... |

|

| Tax benefit on donation to approved trust |

|

TAX TALK

CA. NARESH JAKHOTIA

Advance tax Rules:

Calculation of advance tax purely involves estimation of tax li...

Continue Reading... |

|

| Unsold flats of builders attracts tax on notional basis |

|

TAX TALK-28.08.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Notional taxation in the case...

Continue Reading... |

|

| Professionals excluded from maintaining accounts if offers 50% of receipt as income |

|

The taxability of receipt depends upon the relationship between the payer and payee. If the employer / employee relationship exists then income would ...

Continue Reading... |

|

| Interest on Saving Bank account up to Rs. 10,000/- is eligible for deduction u/s 80TTA |

|

sTAX TALK-14.08.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Section 80TTA ...

Continue Reading... |

|

| Payment for eviction of tenant is eligible for deduction |

|

TAX TALK-07.08.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Capital gain is calculated by...

Continue Reading... |

|

| Payment for eviction of tenant is eligible for deduction |

|

TAX TALK-07.08.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Capital gain is calculated by deducting the cost of acq...

Continue Reading... |

|

| Taxation of Alimony |

|

TAX TALK-31.07.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

The j...

Continue Reading... |

|

| Quoting of PAN is mandatory if transaction value exceeds Rs. Rs. 2 Lakh |

|

TAX TALK-24.07.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

There...

Continue Reading... |

|

| Income tax law incorporates numerous provisions to curb cash transactions. It will not only help in controlling black money generation but would also widen the tax base: Tax Talk |

|

TAX TALK-17.07.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

New section 269ST is introd...

Continue Reading... |

|

| Invest in Gold through Gold Sovereign Bond |

|

TAX TALK-10.07.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Investment in...

Continue Reading... |

|

| Income tax without actual income: Second house property |

|

TAX TALK-03.07.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Tax treatment of the second...

Continue Reading... |

|

| Cost Inflation Index for the FY 2017-18 notified as “272†|

|

TAX TALK-26.06.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Any taxpayer selling the ol...

Continue Reading... |

|

| ELSS income is totally tax free |

|

TAX TALK-19.06.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Equity Linked Savings Scheme (ELSS)...

Continue Reading... |

|

| Proper documentations & planning could lower tax incidence |

|

TAX TALK-12.06.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

U/s 56(2)(x), if anyone purchases a...

Continue Reading... |

|

| Issues in taxation of capital gain |

|

TAX TALK-05.06.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

For exemption u/s 54, investment of...

Continue Reading... |

|

| No SFT to be filed if there is no reportable transaction |

|

TAX TALK-29.05.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

To curb circu...

Continue Reading... |

|

| File Statement of Financial Transactions (SFT) by 31st May 2017 |

|

TAX TALK-22.05.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

File Statement of Financial Transacti...

Continue Reading... |

|

| I-T department is very efficiently capturing & analyzing the data |

|

TAX TALK-15.05.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

I-T department is very efficiently ca...

Continue Reading... |

|

| LTCG exemption will be withdrawn if the new house is transferred within 3 years |

|

TAX TALK-08.05.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

LTCG exemption will be withdr...

Continue Reading... |

|

| Even cash deposited in new currency is required to be reported in new ITR |

|

TAX TALK-01.05.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Even cash deposited in new cu...

Continue Reading... |

|

| Ownership of House property & Deduction on Housing Loan |

|

TAX TALK-24.04.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Ownership of House property & Ded...

Continue Reading... |

|

| Surgical strike on cash- accepting cash of Rs. 2 Lakh and more is an offence now- Section 269ST |

|

Surgical strike on cash- accepting cash of Rs. 2 Lakh and more is an offence now- Section 269ST

CA. Naresh Jakhotia- Chartered Accountant

...

Continue Reading... |

|

| Tax issues in Joint Development agreement signed before 01/04/2017 |

|

FINAL

TAX TALK-17.04.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Tax issues in Joint De...

Continue Reading... |

|

| All about tax benefit on Education Loan |

|

TAX TALK-10.04.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

All about tax benefit on Education Lo...

Continue Reading... |

|

| Without actual income also, Income tax can be levied:Tax Talk |

|

TAX TALK-03.04.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

No Income- No Tax is not the law

&nb...

Continue Reading... |

|

| Promoting affordable housing scheme by tax sops to builders & developers |

|

TAX TALK-27.03.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Promoting affordable housing scheme b...

Continue Reading... |

|

| Tax Relief to the property owners signing Joint Development Agreement |

|

TAX TALK-20.03.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Tax Relief to the property owners sig...

Continue Reading... |

|

| Revision in the base year would result in tax saving |

|

TAX TALK-13.03.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Revision in the base year would...

Continue Reading... |

|

| How to comply with the Non-filers Monitoring System (NMS) notices |

|

TAX TALK-06.03.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

How to comply with the Non-filers Mon...

Continue Reading... |

|

| Tax deduction on education loan taken for higher studies |

|

TAX TALK-27.02.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Tax deduction on education loan taken...

Continue Reading... |

|

| Second house property: Income tax without actual income |

|

TAX TALK-20.02.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Second house property: Income tax wit...

Continue Reading... |

|

| Income tax is not always on real Income |

|

TAX TALK-13.02.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Income tax is not always on real Inco...

Continue Reading... |

|

| Keep proper records & documents of expenses for claiming deduction |

|

TAX TALK-06.02.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Keep proper records & documents o...

Continue Reading... |

|

| New retail investors are eligible for tax benefit u/s 80CCG |

|

TAX TALK-30.01.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

New retail investors are elig...

Continue Reading... |

|

| TDS ON PAYMENT TO CONTRACTORS AND SUB-CONTRACTORS UNDER SECTION 194C AN OVERVEIW |

|

TDS ON PAYMENT TO CONTRACTORS AND SUB-CONTRACTORS UNDER SECTION 194C AN OVERVEIW

By Reema Agrawal

– Article Assistant

- SSRPN &a...

Continue Reading... |

|

| Tax implications on relinquishment deed amongst family members |

|

TAX TALK-23.01.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Tax implications on relinquishment de...

Continue Reading... |

|

| Medical expense on cancer & tax deduction |

|

TAX TALK-16.01.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Medical exp...

Continue Reading... |

|

| Claim Tax Credit on Foreign Income of a Resident |

|

TAX TALK-09.01.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Claim Tax Credit on Foreign Income of...

Continue Reading... |

|

| Senior citizens are exempt from payment of advance tax |

|

TAX TALK-02.01.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Senior citizens are exempt from pay...

Continue Reading... |

|

| Senior citizens are exempt from payment of advance tax |

|

TAX TALK-02.02.2017-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Senior citizens are exempt from payme...

Continue Reading... |

|

| Investment in 5 years fixed deposits also offers tax benefit |

|

TAX TALK-26.12.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Investment in 5 y...

Continue Reading... |

|

| Service tax on under construction property |

|

Service tax on under construction property

Ku. Neelam Kabra -

Article Assistant

-SSRPN & CO

Law & its interpr...

Continue Reading... |

|

| No tax on receipt of accidental death claim |

|

TAX TALK-19.12.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

No tax on receipt of accidental death...

Continue Reading... |

|

| Purchase of rural agricultural land below stamp duty value is not liable for notional taxation |

|

TAX TALK-12.12.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Purchase of rural agricultura...

Continue Reading... |

|

| Pradhan Mantri Garib Kalyan Yojna- 2016: Last call to come clean |

|

TAX TALK-05.12.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Pradhan Mantri Garib Kalyan Yojna- 20...

Continue Reading... |

|

| Even self employed person can claim deduction towards rent of house property |

|

X TALK-28.11.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Even self employed person can c...

Continue Reading... |

|

| Write up on the controversial issue- whether penalty @ 200% leviable for unaccounted cash deposit: Tax Talk Dated 21.11.2016 |

|

TAX TALK-21.11.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Whether 200% penalty levi...

Continue Reading... |

|

| Demonetization of money & income tax |

|

TAX TALK-14.11.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

&nb...

Continue Reading... |

|

| Keep proper records & documents of expenditure incurred on property for claiming deduction |

|

TAX TALK-07.11.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Keep proper records & documents of ...

Continue Reading... |

|

| Whether two adjacent flats can be regarded as “One †house property |

|

TAX TALK-24.10.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Whether two adjacent flats can be reg...

Continue Reading... |

|

| Categorization of shares income decides its taxability |

|

TAX TALK-17.10.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Categorization of shares inco...

Continue Reading... |

|

| Exchange of property results in capital gain tax liability |

|

TAX TALK-10.10.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Exchange of property results in capit...

Continue Reading... |

|

| CBDT amends format of 3CD Report wef 01.04.2017 |

|

CBDT amends format of 3CD Report wef 01.04.2017

In the Income-tax Rules, 1962, in Appendix II , in Form No. 3CD, in Part-B, in claus...

Continue Reading... |

|

| NRI can continue making deposit in the existing PPF account |

|

TAX TALK-03.10.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

NRI can continue making deposit in th...

Continue Reading... |

|

| Issues in Capital gain taxation |

|

TAX TALK-26.09.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Issues in Capital gain taxation

&nbs...

Continue Reading... |

|

| How to invest in National Pension Scheme (NPS) |

|

TAX TALK-19.09.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

How to invest in National Pen...

Continue Reading... |

|

| Seller should obtain PAN if bill amount exceeds Rs. 2 Lakh |

|

TAX TALK-12.09.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Seller should obtain PAN if bill amou...

Continue Reading... |

|

| Claim income tax refund for the last 6 years or carry forward the loss even if return is not filed |

|

TAX TALK-05.09.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Claim income tax refund for the last 6 ...

Continue Reading... |

|

| Taxpayers are entitled to get interest on income tax refund |

|

TAX TALK-29.08.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Taxpayers are entitled to get interest ...

Continue Reading... |

|

| Sukanya Samriddhi Account: New scheme for a Girl Child In India |

|

TAX TALK-22.08.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Sukanya Samriddhi Account: New scheme...

Continue Reading... |

|

| Pay as you earn - Advance Tax |

|

TAX TALK-01.08.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Pay as you earn - Advance Tax

...

Continue Reading... |

|

| Capital gain on transaction by Power of Attorney (POA) |

|

TAX TALK-25.07.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Capital gain on transaction by Power ...

Continue Reading... |

|

| Medical expenses offers tax benefit |

|

TAX TALK-18.07.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

M...

Continue Reading... |

|

| Save additional tax by investing in NPS |

|

TAX TALK-11.07.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Save additional tax by investing in N...

Continue Reading... |

|

| Disclose exempt income while filing ITR |

|

eTAX TALK-04.07.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Disclose exempt income while filing ...

Continue Reading... |

|

| Residential status vs. Taxability of Income |

|

TAX TALK-27.06.06.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Residential status vs. Taxability of Inc...

Continue Reading... |

|

| Residential status vs. Taxability of Income |

|

TAX TALK-27.06.06.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Residential status vs. Taxability of Inc...

Continue Reading... |

|

| Joint development agreement & capital gain tax |

|

TAX TALK-20.06.06.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Joint development agreement & capita...

Continue Reading... |

|

| Know clubbing provision before gifting to wife |

|

Know clubbing provision before gifting to wife

TAX TALK-13.06.06.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Charte...

Continue Reading... |

|

| Not all proceeds from Life Insurance policies are tax free |

|

TAX TALK-06.06..2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Not all proceeds from Life Insurance polic...

Continue Reading... |

|

| Court recongnised the concept of accountability- A judgement by Bombay High Court |

|

~~Larsen & Toubro Limited vs. UOI (Bombay High Court)

Reluctance of AOs to comply with binding Court judgements leads to negative reactions amo...

Continue Reading... |

|

| No excuse, Purchasing property below stamp duty valuation is taxable |

|

~~TAX TALK-30.05.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

No excuse, Purchasing property ...

Continue Reading... |

|

| Tax treatment of gratuity received by LIC agent |

|

TAX TALK-23.05.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Tax treatment of gratuity received by LIC a...

Continue Reading... |

|

| CBDT has revised the due date for filing TDS Return (TCS returns filing date unchanged) |

|

The CBDT vide Notification No. 30/2016 [F.NO.142/29/2015-TPL], Dated 29-4-2016 has revised the du...

Continue Reading... |

|

| Intricacies in Columns of revised Form No. 15G & 15H |

|

TAX TALK-16.05.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Intricacies in Columns of revised Form No. ...

Continue Reading... |

|

| Capital gain exemption if Construction is done on the plot owned by spouse |

|

~~TAX TALK-09.05.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Capital gain exemption if Const...

Continue Reading... |

|

| Eligible Start-up - 100% Tax Holiday for 3 years |

|

TAX TALK-02.05.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Query 1]

Start up India ...

Continue Reading... |

|

| The difference between tax avoidance and tax evasion is the thickness of a prison wall. Tax Talk - My weekly column |

|

...

Continue Reading... |

|

| Non filers may take the benefit of Income Disclosure Scheme-2016 |

|

TAX TALK-25.04.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Non filers may take the benefit of Income D...

Continue Reading... |

|

| Scholarship received to meet the cost of education is tax free |

|

TAX TALK-18.04.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Scholarship received to meet the cost of ed...

Continue Reading... |

|

| New option for saving Long Term Capital Gain Tax |

|

TAX TALK-04.04.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

New option for saving Long Term Capital Gai...

Continue Reading... |

|

| Tax deduction towards medical treatment & maintenance of a dependant with disability |

|

TAX TALK-28.03.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Tax deduction towards medical treatment &am...

Continue Reading... |

|

| Profit arising from sale of property & Tax saving options |

|

TAX TALK-21.03.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Profit arising from sale of property & ...

Continue Reading... |

|

| Medical reimbursement for treatment in approved private hospital is tax free |

|

TAX TALK-14.03.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Medical reimbursement for treatment in appr...

Continue Reading... |

|

| Minor’s income is not subject to clubbing provision in the hands of the Grandfather or Grandmother |

|

TAX TALK-07.03.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Minor’s income is not subject to club...

Continue Reading... |

|

| Reduce the tax liability on arrears of salary by claiming relief u/s 89 |

|

TAX TALK-29.02.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Reduce the tax liability on arrears of salary by ...

Continue Reading... |

|

| Avail additional tax bonanza by investing Rs. 50,000/- in National Pension Scheme (NPS) |

|

Avail the Tax Bonanza by investing Rs. 50,000/- in NPS

CA Naresh Jakhotia

One of the biggest tax saving bonanza by th...

Continue Reading... |

|

| Not actual rent, House property is taxable on the basis of its Annual Value |

|

TAX TALK-22.02.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Not actual rent, House property is taxable ...

Continue Reading... |

|

| File the return in time to enjoy the benefit of carry forward of loss |

|

TAX TALK-15.02.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

File the return in time to enjoy the benefit of c...

Continue Reading... |

|

| Beware, there is a penalty for property transactions in cash |

|

TAX TALK-08.02.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Beware, there is a penalty for property transacti...

Continue Reading... |

|

| Ownership of land is not a pre-requisite for having agricultural income |

|

TAX TALK-01.02.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Ownership of land is not a pre-requisite for havi...

Continue Reading... |

|

| Issues in taxation of Bonus & splitting of Shares |

|

TAX TALK-25.01.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Issues in taxation of Bonus & splitting of Sh...

Continue Reading... |

|

| Taxability in case of Joint Bank FDR |

|

TAX TALK-18.01.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Taxability in case of Joint Bank FDR

Que...

Continue Reading... |

|

| Income tax department acting tough against the Non filers |

|

TAX TALK-11.01.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Income tax department acting tough against the No...

Continue Reading... |

|

| New PAN Quoting requirement |

|

...

Continue Reading... |

|

| Avoid casualness in submission of Form No.15G/15H |

|

TAX TALK-04.01.2016-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Avoid casualness in submission of Form No.15G/15H...

Continue Reading... |

|

| Avail tax benefit if living in a rented premises |

|

TAX TALK-28.12.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Avail tax benefit if living in a rented premises

&...

Continue Reading... |

|

| Age has special privileges in the Income Tax Law |

|

TAX TALK-21.12.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Age has special privileges in the Income Tax Law

...

Continue Reading... |

|

| Income Tax may be payable even if there is no actual income |

|

TAX TALK-14.12.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Income Tax may be payable even if there...

Continue Reading... |

|

| Housing loan & tax treatment of pre-construction period interest |

|

TAX TALK-07.12.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Housing loan & tax treatment of pre-construction pe...

Continue Reading... |

|

| How to get Income tax refund speedily? |

|

TAX TALK-30.11.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

How to get Income tax refund speedily?

Query 1]

Kin...

Continue Reading... |

|

| How to deal with the notice received for non filing of income tax return ? |

|

...

Continue Reading... |

|

| How to deal with the notice received for non filing of income tax return |

|

See the word file attached along with the mail for viewing the Images incorporated in the Column.

TAX TALK-23.11.2015-THE HITAVADA

...

Continue Reading... |

|

| Whether gift from relatives are really tax exempt? |

|

See the file attached for the Charts incorporated in the Presentation

TAX TALK-16.11.2015-THE HITAVADA

TAX TALK

CA. NARES...

Continue Reading... |

|

| Death doesn’t absolve the person from tax liability |

|

TAX TALK-09.11.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Death doesn’t absolve the per...

Continue Reading... |

|

| How long should I keep my income tax records? |

|

TAX TALK-02.11.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

How long should I keep my income ta...

Continue Reading... |

|

| Taxation of income from delivery based / intra-day share trading and F & O Transactions |

|

TAX TALK-26.10.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Taxation of income from delivery based / in...

Continue Reading... |

|

| Senior Citizen Saving Scheme- An investment cum tax saving option for senior citizen |

|

TAX TALK-26.10.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Senior Citizen Saving Scheme- An invest...

Continue Reading... |

|

| Holding more than one PAN card |

|

TAX TALK-12.10.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Holding more than one PAN card

...

Continue Reading... |

|

| Income tax return can be filed for 6 assessment years to claim TDS Refund |

|

TAX TALK-05.10.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Income tax return can be filed for 6 as...

Continue Reading... |

|

| TDS credit can be claimed even if it is not deposited by the Deductor |

|

TAX TALK-28.09.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

TDS credit can be claimed even if it is...

Continue Reading... |

|

| CBDT told to extend the date of filing return !! Strictures passed against CBDT !! |

|

​

All Gujarat Federation Of Tax Consultants vs. CBDT (Gujarat High Court)

Strictures passed against CBDT for being lax and delaying issuing...

Continue Reading... |

|

| Do understand Clubbing provision before making Gift - A family route to save tax |

|

TAX TALK-21.09.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Do understand Clubbing provision before...

Continue Reading... |

|

| Scratch cards & Lottery schemes are subject to Tax Deduction at Source |

|

TAX TALK-14.09.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Scratch cards & Lottery schemes are...

Continue Reading... |

|

| Assessee with Multiple businesses & Applicability of Tax Audit limit of Rs. 1 Crore |

|

TAX TALK-07.09.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Assessee with Multiple businesses &...

Continue Reading... |

|

| Compulsory manual selection of cases for scrutiny during the Financial Year 2015-2016 |

|

Compulsory manual selection of cases for scrutiny during the Financial Year 205-2016

To

Government of India

Ministry of Finance

...

Continue Reading... |

|

| REGISTRATION IN GST (Proposed): |

|

Registration in GST

REGISTRATION IN GST (Proposed)

Registration No can be PAN based followed by alphabets, numerals etc. (Eg. 10...

Continue Reading... |

|

| Interest on Housing loan shall be restricted to Rs. 30,000/- if construction not completed within 3 years |

|

TAX TALK-31.08.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Interest on Housing loan shall be...

Continue Reading... |

|

| CM's wife case : Penalty for violation of section 269SS - Reasonable cause u/s 273B |

|

I-T - Relief for UP Chief Minister's wife - Whether genuinity of loan transaction can be doubted merely on ground of its acceptance in cash, when ...

Continue Reading... |

|

| NON PAYMENT OF TDS ATTRACTS PROSECUTION |

|

TAX TALK

NON PAYMENT OF TDS ATTRACTS PROSECUTION

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

...

Continue Reading... |

|

| Interest on NPAs and Stick Loans, even if accrued as per the mercantile system of accounting, is not taxable as per prudential norms |

|

Interest on NPAs and Stick Loans, even if accrued as per the mercantile system of accounting, is not taxable as per prudential norms

CIT vs. Deogir...

Continue Reading... |

|

| S. 115JB: Amount towards waiver of loan under OTSS, credited to "General Reserves" and not to the P&L Account cannot be added to "book profits" |

|

S. 115JB: Amount towards waiver of loan under OTSS, credited to "General Reserves" and not to the P&L Account cannot be added to "b...

Continue Reading... |

|

| S. 115JB: Dept’s grievance that if amount is not credited to P&L A/c, accounts are not correctly prepared as per Schedule VI to the Companies Act, 1956 and adjustment to book profits can be made is not acceptable if auditors and ROC have not found fault |

|

CIT vs. Forever Diamonds Pvt. Ltd (Bombay High Court)

COURT:

Bombay High Court

CORAM:

M. S. Sanklecha J...

Continue Reading... |

|

| Failure to deduct taxes or wrong deduction of TDS |

|

Failure to deduct taxes or wrong deduction of TDS (non deposit, short deposit or late deposit):

Default/ Failure

Section

&nb...

Continue Reading... |

|

| S. 234B interest is automatic if conditions are met. Form I.T.N.S. 150 is a part of the assessment order and it is sufficient if the levy of interest is stated there |

|

CIT vs. Bhagat Construction Co. Pvt. Ltd (Supreme Court)

COURT:

Supreme Court

CORAM:

A.K. Sikri J.,&nbs...

Continue Reading... |

|

| Scope of Section 2(15)- In Favor of Assessee |

|

IT : Where motive of assessee is not generation of profit but to provide training to needy women in order to equip or train them and make them self-co...

Continue Reading... |

|

| INVESTMENT IN PLOT IS ELIGIBLE FOR CAPITAL GAIN EXEMPTION |

|

TAX TALK-17.08.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

INVESTMENT IN PLOT IS ELIGIBLE FOR CA...

Continue Reading... |

|

| Section 271(1)(c) provides that penalty can be only imposed if the authority was satisfied that any person had concealed particulars of his income or furnished inaccurate particulars of such income |

|

COMMISSIONER OF INCOME TAX vs.DALIMA DYECHEM INDUSTRIES LTD.

HIGH COURT OF BOMBAY

- Penalty u/s 271(1)(c)—Levy of&mdash...

Continue Reading... |

|

| Bogus sales and purchases: Reliance on statement of supplier who confesses to providing accommodation entries without giving assessee right of cross-examination violates principles of natural justice and the addition has to be deleted in toto |

|

ACIT vs. Tristar Jewellery Exports Pvt. Ltd (ITAT Mumbai)

COURT:

ITAT Mumbai

CORAM:

A. D. Jain (JM), Rajen...

Continue Reading... |

|

| IT : Deduction of TDS under wrong provision of law will not save assessee from disallowance u/s 40(a)(ia) |

|

The ratio may be a case specific and may not sustain longer.

Further, if deduction rate is same in two sections, wrong mentioning of sectio...

Continue Reading... |

|

| I-T - Whether Sec 54F benefit is available to assessee when construction work though has started but is not yet complete in all respects within stipulated period |

|

2015-TIOL-1841-HC-KAR-IT

CIT Vs B S Shanthakumari

I-T - Whether Sec 54F benefit is available to assessee when constructi...

Continue Reading... |

|

| Filing of appeal with complete knowledge of its fate by the Revenue only reflects the mischievous adamancy to attempt to mislead the Tribunal and waste the time of the Court and the officers concerned. |

|

IT : Filing of appeal with complete knowledge of its fate by the Revenue only reflects the mischievous adamancy to attempt to mislead the Tribunal and...

Continue Reading... |

|

| Addition on account of cash credit- In favor of Assessee |

|

DEPUTY COMMISSIONER OF INCOME TAX vs.VKA FINANCE & INVESTMENT CO.

AHMEDABAD TRIBUNAL

IIncome—Cash credits—

AO noticed a...

Continue Reading... |

|

| Penalty under section 271D not leviable where cash accepted to meet exigencies of business |

|

Property transactions also added in section 269SS & 269T. Obviously, 271D importance would be rising day by day:

Commissioner of Income Tax v. ...

Continue Reading... |

|

| ITR FORMS: THE WAIT IS FINALLY OVER |

|

TAX TALK-10.08.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

ITR FORMS: THE WAIT IS FINALLY OVER

...

Continue Reading... |

|

| NRI: Basic exemption limit cannot be reduced from LTCG |

|

TAX TALK-03.08.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

NRI: Basic exemption limit cannot be ...

Continue Reading... |

|

| Deductor liable for penalty @ Rs. 100/- per day if TDS certificates are not downloaded |

|

TAX TALK-27.07.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Deductor liable for penalty @ Rs. 100...

Continue Reading... |

|

| No tax audit required even if receipts by truck owner exceeds Rs. 1 Cr |

|

TAX TALK-20.07.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

No tax audit required even if receipt...

Continue Reading... |

|

| Income from funds transferred to Wife attracts clubbing provision |

|

TAX TALK-13.07.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Income from funds transferred to Wife...

Continue Reading... |

|

| Classification of income is important from tax planning perspective |

|

TAX TALK-06.07.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Classification of income is important...

Continue Reading... |

|

| A step-by-step guide to file income tax return |

|

TAX TALK-29.06.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

A step-by-step guide to file income t...

Continue Reading... |

|

| TDS has to be done while purchasing Urban Agricultural Land also |

|

TAX TALK-30.03.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

TDS has to be done while purchasing Urban Agric...

Continue Reading... |

|

| Life Insurance Policies: No blanket escape from tax |

|

TAX TALK-16.03.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

Life Insurance Policies: No blanket...

Continue Reading... |

|

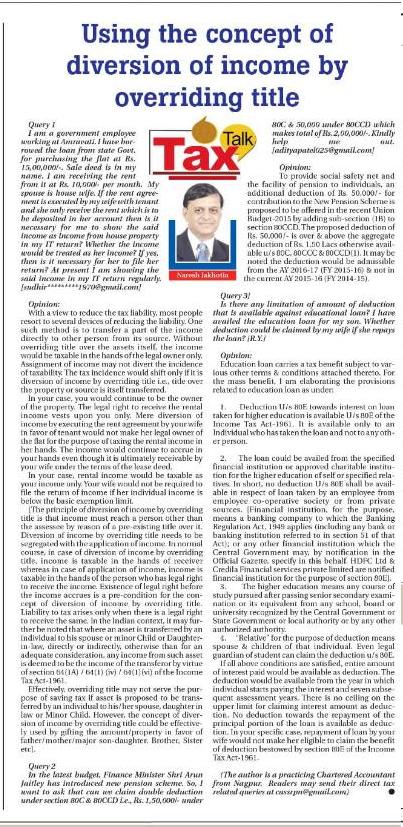

| USING THE CONCEPT OF DIVERSION OF INCOME BY OVERRIDING TITLE |

|

TAX TALK-09.03.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

USING THE CONCEPT OF DIVERSION OF INCOME BY OVE...

Continue Reading... |

|

| ALL ABOUT EDUCATION LOAN |

|

ALL ABOUT EDUCATION LOAN:

Query ]

Is there any limitation of amount of deduction that is available against educational loan? I have availed the ed...

Continue Reading... |

|

| CO-OWNER MAY NOT BE TREATED AS OWNER: INTERESTING INCOME TAX |

|

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

CO-OWNER MAY NOT BE TREATED AS OWNER: INTERESTING INCOME TAX

Query 1]

...

Continue Reading... |

|

| TAX ISSUES ON ANCESTRAL AGRICULTURAL LAND |

|

TAX TALK-23.02.2015-THE HITAVADA

TAX TALK

CA. NARESH JAKHOTIA

Chartered Accountant

TAX ISSUES ON SALE OF ANCESTRAL AGRICUL...

Continue Reading... |

|

| TWO PERSON WITH SAME INCOME MAY HAVE DIFFERENT TAX LIABILITIES !! |

|

INTERESTING INCOME TAX

-CA NARESH JAKHOTIA

“EVEN IF TWO PEOPLE HAVE SAME INCOME, THE TAX AMOUNT COULD DIFFER”

&...

Continue Reading... |

|

| CAPITAL GAIN EXEMPTION ON SALE OF DEPRECIABLE ASSETS |

|

INTERESTING INCOME TAX

-CA NARESH JAKHOTIA

DEPERECIABLE ASSETS U/S 50

AND EXEMPTION BENEFIT U/S 54EC/54F

A principal asked one of ...

Continue Reading... |

|

.png)