Article Details

| Keep proper records & documents of expenditure incurred on property for claiming deduction |

|

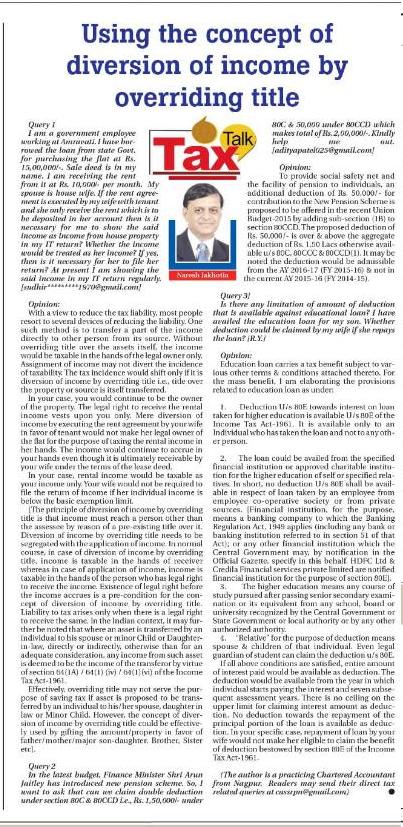

TAX TALK-07.11.2016-THE HITAVADA TAX TALK CA. NARESH JAKHOTIA Chartered AccountantKeep proper records & documents of expenditure incurred on property for claiming deduction Query 1] I am a middle level person employed in a private firm and filing my IT Return for the last few years under the Salaried Category. I seek your advice on LTCG. I have purchased a plot of land measuring 1,500 sq ft. at Jabalpur in the year 2001 at a cost of Rs. 30,400/- and constructed a house on the municipal Corporation approved drawing of 800 sq ft. The total amount spent by me for the building, super structure and boundary wall etc stood at around Rs. 12 lacs, of which I had taken a loan of Rs. 4.00 lacs from Bank and balance amount by selling gold ornaments of my wife, taking personal loans from relatives and friends as also from my own savings from Salary etc. However, for lack of knowledge about the LTCG etc, I could not keep records of payments to various contractors & of purchase of materials etc. except only a part of it i.e., bills of some items purchased but not a single receipt for payments to labors of civil & other works. The construction of the building was completed in February’2002 starting from June’2001and have started residing in it from 24.02.2002. In view of my retirement in the near future, I plan to dispose of this self-occupied Residential property within this Financial Year and go for another residential property at my Native Place to be occupied and resided by myself. Now, I would like to have your kind advice on the following:

1. You have constructed the house property long back in the year 2001 to 2002. Documents & records play a very vital & indispensable role while claiming deduction under most of the provision of Income Tax Act. Onus to prove the expenses incurred is on the taxpayers. Though taxpayers are advised to properly keep the documentary evidences of expenses incurred along with source of payment, there are various instances where the documentary evidences are not available with the taxpayers in respect of development / improvement cost incurred by them from time to time which obstructs the claim towards deduction. 2. In your case, you have taken the housing loan for construction over the property and have few bills/voucher and other documents (like sanction map etc) to justify the incurrence of construction expenses over the said plot. Further, it appears that you have enough evidence of the source of money invested (like salary, sale of wife’s gold etc) towards construction of house property. Even though some of bills/vouchers like labor expenses, contractor’s payments are missing; other evidences/facts could serve the purpose. 3. As a further evidentiary measure, you are advised to obtain the certificate from the government approved valuer to justify the amount incurred in the house property. Based on the housing loan statement, gold loan utilized towards construction of house property, available bills / vouchers/photographs available further supported by the government approved valuer report, you can claim deduction towards construction/development expenses incurred over the plot purchased by you in the year 2001. 4. You have purchased the plot & incurred construction expenses in the in the year 2001-02. The cost inflation index (CII) for the FY 2001-02 was “426“whereas it is “1125” for the FY 2016-17. 5. Your purchase price of plot was Rs. 30,400/-. You can further add the stamp duty, registration fees & other expenses incurred while purchasing the plot to arrive at the cost of acquisition. Ignoring stamp duty etc, your indexed cost of acquisition would be Rs. 80,281/- (Rs. 30,400/- *1125/426) & indexed cost of construction is Rs. 31,69,014/- (Rs. 12 Lakh * 1125/426).

Any taxpayer can save LTCG tax by claiming an exemption u/s 54EC by investing the amount of LTCG within a period of 6 months in a specified bonds issued by NHAI / REC. These capital gain tax saving bonds have a lock-in-period of 3 years. [The author is a practicing Chartered Accountant from Nagpur. Readers may send their direct tax related queries at SSRPN & Co 10, Laxmi Vyankatesh Apartment C.A. Road, Telephone Exch. Square Nagpur-440008 or email it at nareshjakhotia@ssrpn.com] |

|

.png)