Article Details

| Not all proceeds from Life Insurance policies are tax free |

|

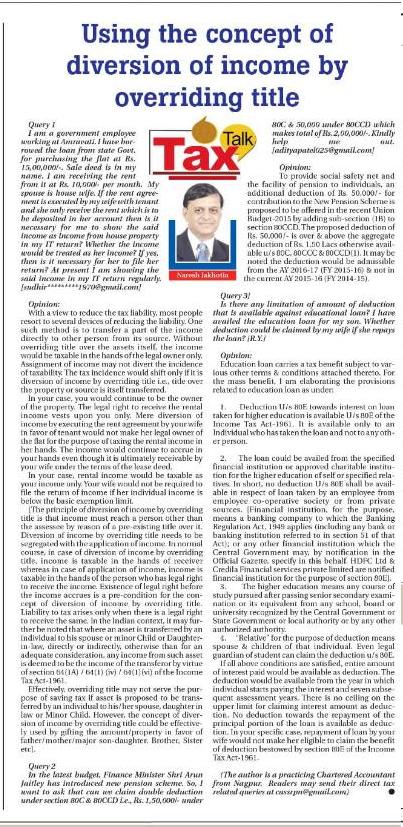

TAX TALK-06.06..2016-THE HITAVADA TAX TALK CA. NARESH JAKHOTIA Chartered AccountantNot all proceeds from Life Insurance policies are tax free Query 1] 1. I am having a LIC policy (Jeevan Anand) for Rs. 2 lacs which will be maturing in Dec-2016. Yearly premium is Rs. 27, 344/- and policy commenced in Dec 2005 and ended in Dec 2015. My query is: i. Whether TDS is applicable under section 194DA? ii. Whether the full maturity amount receivable by me is to be shown as "Income from other Sources" in the return for FY 2016-17? I am a retired Govt. employee with a pension of Rs. 10,065/- per month. My present income is interest on FDs in addition to the above mentioned pension. Kindly advise. [Vechickattu Manikanda Menon-vmkm1949@gmail.com

Entire maturity benefits (including bonus) from life insurance policies would be tax free in the hands of policyholders if, at any point of time during the policy term, annual premiums payable in any year do not exceed 20% of the basic sum assured in respect of policies issued on or after 01.04.2003 but before 31.03.2012. For policy issued on or after 01.04.2012, annual premium should not exceed 10% (15% in case of handicapped person or person suffering from specified diseases) of sum assured. Effectively, there is no escape from tax on insurance proceeds if the premium paid exceeds 20% or 10% or 15% of the sum assured. Similarly, the amount received under a keyman insurance policy is also not eligible for exemption u/s 10(10D). Further, premium paid on life insurance policy is eligible for deduction u/s 80C subject to the condition that maximum amount of premium should be within 20% or 10% or 15% of the sum assured, as mentioned above. To track the taxability of such transactions, a new section 194DA has been inserted under the Act to provide for deduction of tax at the rate of 1% (earlier 2%) on sum paid under a life insurance policy which is not exempt under section 10(10D). But no deduction under this provision shall be made if the aggregate sum paid in a financial year to an assessee is less than Rs 1,oo,ooo/-. In short, Section 194DA envisages TDS only on the policies payouts which are not exempt under Section 10(10D). The present rate of TDS is 1% for valid PAN registered payee & 20% for invalid or no PAN holder. First part of the query: In your specific case, since the conditions of section 10(10D) is not violated with regards to premium vis a vis sum assured (i.e., the premium paid in any year is less than 20% of the sum assured), the maturity proceeds would not be subject to TDS U/s 194DA. Further, entire maturity proceeds would be tax free u/s 10(10D). Second part of the query: If the policy premium was not exceeding 20% of the sum assured, no benefit of set off or carry forward of loss would be there. The basic taxation principle is that, if income from a particular source is exempt from tax then loss from such source cannot be set off against any other income which is chargeable to tax. If, however, policy premium exceeds the said cap of 20%, then the benefit of set off or carry forward of loss cannot be denied. An important question emerges is the head under which income would be taxable- whether as “Income from Capital Gain” or “Income from Other source”. In my opinion, it would be taxable under the head “Income from capital gain” & loss would be “Long term capital loss” which could be set off against “Long term capital gain” only. Query 2]

First Part of the query: Ownership in a house property is one of the first & foremost vital pre-condition for claiming deduction towards Interest on borrowed capital u/s 24(b) & towards Principal repayment u/s 80C of the Income Tax Act -1961. Second pre-condition is the availment of loan for house property. Without ownership in the house property, no right would emanate for deduction. If both the conditions are satisfied, then each of the co-owners would be eligible to claim deduction u/s 24(b) & u/s 80C independently. Second Part of the query: Deduction u/s 24(b) towards interest on borrowed capital is available in respect of loan taken from anybody. It is not necessary that loan should have been taken from bank or financial institution or specified credit institution. (Even interest paid on amount borrowed from friends & relatives is eligible for deduction u/s 24(b). However, deduction u/s 80C towards principal repayment is available only if the amount loan is taken from specified persons. The specified person includes Bank, LIC, Housing finance companies etc. LIC, being one of the specified entities, you would be eligible for deduction u/s 80C towards principal repayment. To enable your employer to grant the benefit of deduction, you need to submit the declaration in Form 12BB to your employer. The CBDT (Central Board of Direct Taxes) has introduced a new form (Form 12 BB) for claiming tax deduction towards LTA, LTC, HRA & interest paid for home loans. The new form mandates people to furnish proof of travel while claiming LTA, LTC, and details of landlord in case of HRA claims. To claim deduction on the interest on a housing loan, employee needs to provide PAN of the lender and their name and address. [The author is a practicing Chartered Accountant from Nagpur. Readers may send their direct tax related queries at SSRPN & Co 10, Laxmi Vyankatesh Apartment C.A. Road, Telephone Exch. Square Nagpur-440008 or email it at nareshjakhotia@ssrpn.com]. |

|

.png)