Article Details

| CO-OWNER MAY NOT BE TREATED AS OWNER: INTERESTING INCOME TAX |

|

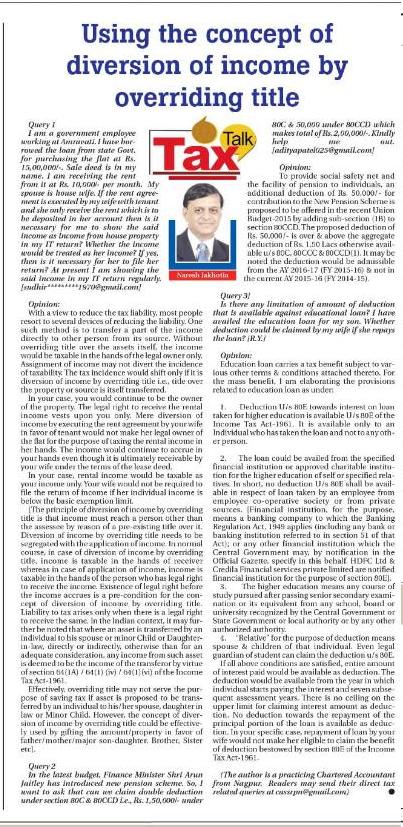

TAX TALK CA. NARESH JAKHOTIA Chartered Accountant CO-OWNER MAY NOT BE TREATED AS OWNER: INTERESTING INCOME TAX Query 1] I had a query regarding LTCG, the details are as follows:

Opinion: Under section 54F of the Income Tax Act, 1961 exemption is available to individual/HUF assessee on the long- term capital gain arising from the transfer of any long-term capital assets (other than the residential house property) provided net sale consideration is invested for purchase/construction of a residential house property within prescribed time period from the date of transfer. There are various misconceptions about the availability of exemption u/s 54F. For the benefit of the masses, I am elaborating the main stipulations for claiming an exemption u/s 54F as under:

You already own one flat in a building in your individual name. Additionally, you have a share in another residential property wherein your wife & 2 sons are co-owners. To be more precise, you have complete ownership over one flat only. Coming to the point in the query, exemption u/s 54F is not available if on the date of transfer of the original assets, the taxpayer owns more than one residential house property (other than the new house). The crucial deciding factor in your query is the interpretation of one small word “Own”. A person having co-ownership (Partial) rights in two or more residential house properties, still an exemption u/s 54F can be enjoyed if an option of investment in purchase of another residential house property is exercised? Whether a person having a co-ownership (Partial) right in any other residential house property will be considered at par with the full ownership right or not is the issue that one needs to decide. The concept of joint ownership or co-ownership is getting preferences now a day for various logical purposes. Going through the straight & plain interpretation of the language given in the Act, the first impression anyone gets is that the co-ownership can be taken as the full unit for the purpose of section 54F and will disentitle the assessee with the benefit of section 54F if assessee owns more than one residential house property (even though it is a joint ownership). But there is an differing & divergent judgment delivered by Mumbai Tribunal in case of ITO Vs. Rasiklal N. Satra (2006) 98 ITD 335 wherein the it is held that the proviso to Section 54F(1) uses the expression “owns more than one residential house” and the term “own” would include only the case where a residential house is fully and wholly owned by the assessee. The Tribunal held that it would not include a residential house owned by more than one person. The relevant text of the judgment is reproduced hereunder: “The only question remains as to whether assessee can be said to be the owner of that residential house. The Legislature has used the word “a” before the words “residential house”. In our opinion, it must mean a complete residential house and would not include shared interest in a residential house. Where the property is owned by more than one person, it cannot be said any one of them is the owner of the property. In such case, no individual person of his own can sell the entire property. No doubt, he can sell his share of interest in the property but as far as the property is considered, it would continue to be owned by co-owners. Joint ownership is different from absolute ownership. In the case of residential unit, none of the co-owners can claim that he is the owner of residential house. Ownership of a residential house, in our opinion, means ownership to the exclusion of all others. Therefore, where a house is jointly owned by two or more persons, none of them can be said to be the owner of that house. This view of ours is fortified by the judgment of the Hon’ble Supreme Court in the case of Seth Banarsi Dass Gupta v. CIT (1987) 166 ITR 783 (SC) wherein, it was held that a fractional ownership was not sufficient for claiming even fractional depreciation under section 32 of the Act. Because of this judgment, the legislature had to amend the provisions of section 32 with effect from1-4-1997 by using the expression “owned wholly or partly”. So, the word “own” would not include a case where a residential house is partly owned by one person or partly owned by other person(s). After the judgment of Supreme Court in the case of Seth Banarsi Dass Gupta (supra), the Legislature could also amend the provisions of section 54F so as to include part ownership. Since, the Legislature has not amended the provisions of section 54F, it has to be held that the word “own” in section 54F would include only the case where a residential house is fully and wholly owned by assessee and consequently would not include a residential house owned by more than one person. In the present case, admittedly the house at Sion, Mumbai, was purchased jointly by assessee and his wife. It is nobody’s case that wife is benami of assessee. Therefore, the said house was jointly owned by assessee and his spouse. In view of the discussions made above, it has to be held that assessee was not the owner of a residential house on the date of transfer of original asset. Consequently, the exemption under section 54F could not be denied to assessee”. Going by the conclusions drawn by Mumbai tribunal, you are eligible to exemption u/s 54F. However, the issue is not free from doubt. There is a contrast in the judgment rendered by Hyderabad Tribunal in the case of ITO, Ward-6(3) Vs. Apsara Bhavana Sai (2013) 40 Taxmann 528. Controversy prevails due to divergent views by two tribunals & the issue has not yet reached finality. In view of diverse view by tribunals, your exemption claim could be a matter of dispute & litigation. The revenue may not accept the ratio set out in the case of Rasiklal Satra case. To have an undisputed exemption claim u/s 54F, you can think of other alternatives like gifting of your independent house property or share in a jointly owned house property in favor of other family members prior to selling of your plot/land. [The author is a practicing Chartered Accountant from Nagpur. Readers may send their direct tax related queries at SSRPN & Co, 10, Laxmi Vyankatesh Apartment, C.A. Road, Telephone Exch. Square, Nagpur-440008 or email it at cassrpn@gmail.com or at www.ssrpn.com . If you wish to unsubscribe from the mailing list, please reply back “unsubscribe” on the same email id] TAX TALK-02.03.2015-THE HITAVADA TAX TALK CA. NARESH JAKHOTIA Chartered Accountant CO-OWNER MAY NOT BE TREATED AS OWNER: INTERESTING INCOME TAX Query 1] I had a query regarding LTCG, the details are as follows:

Opinion: Under section 54F of the Income Tax Act, 1961 exemption is available to individual/HUF assessee on the long- term capital gain arising from the transfer of any long-term capital assets (other than the residential house property) provided net sale consideration is invested for purchase/construction of a residential house property within prescribed time period from the date of transfer. There are various misconceptions about the availability of exemption u/s 54F. For the benefit of the masses, I am elaborating the main stipulations for claiming an exemption u/s 54F as under:

You already own one flat in a building in your individual name. Additionally, you have a share in another residential property wherein your wife & 2 sons are co-owners. To be more precise, you have complete ownership over one flat only. Coming to the point in the query, exemption u/s 54F is not available if on the date of transfer of the original assets, the taxpayer owns more than one residential house property (other than the new house). The crucial deciding factor in your query is the interpretation of one small word “Own”. A person having co-ownership (Partial) rights in two or more residential house properties, still an exemption u/s 54F can be enjoyed if an option of investment in purchase of another residential house property is exercised? Whether a person having a co-ownership (Partial) right in any other residential house property will be considered at par with the full ownership right or not is the issue that one needs to decide. The concept of joint ownership or co-ownership is getting preferences now a day for various logical purposes. Going through the straight & plain interpretation of the language given in the Act, the first impression anyone gets is that the co-ownership can be taken as the full unit for the purpose of section 54F and will disentitle the assessee with the benefit of section 54F if assessee owns more than one residential house property (even though it is a joint ownership). But there is an differing & divergent judgment delivered by Mumbai Tribunal in case of ITO Vs. Rasiklal N. Satra (2006) 98 ITD 335 wherein the it is held that the proviso to Section 54F(1) uses the expression “owns more than one residential house” and the term “own” would include only the case where a residential house is fully and wholly owned by the assessee. The Tribunal held that it would not include a residential house owned by more than one person. The relevant text of the judgment is reproduced hereunder: “The only question remains as to whether assessee can be said to be the owner of that residential house. The Legislature has used the word “a” before the words “residential house”. In our opinion, it must mean a complete residential house and would not include shared interest in a residential house. Where the property is owned by more than one person, it cannot be said any one of them is the owner of the property. In such case, no individual person of his own can sell the entire property. No doubt, he can sell his share of interest in the property but as far as the property is considered, it would continue to be owned by co-owners. Joint ownership is different from absolute ownership. In the case of residential unit, none of the co-owners can claim that he is the owner of residential house. Ownership of a residential house, in our opinion, means ownership to the exclusion of all others. Therefore, where a house is jointly owned by two or more persons, none of them can be said to be the owner of that house. This view of ours is fortified by the judgment of the Hon’ble Supreme Court in the case of Seth Banarsi Dass Gupta v. CIT (1987) 166 ITR 783 (SC) wherein, it was held that a fractional ownership was not sufficient for claiming even fractional depreciation under section 32 of the Act. Because of this judgment, the legislature had to amend the provisions of section 32 with effect from1-4-1997 by using the expression “owned wholly or partly”. So, the word “own” would not include a case where a residential house is partly owned by one person or partly owned by other person(s). After the judgment of Supreme Court in the case of Seth Banarsi Dass Gupta (supra), the Legislature could also amend the provisions of section 54F so as to include part ownership. Since, the Legislature has not amended the provisions of section 54F, it has to be held that the word “own” in section 54F would include only the case where a residential house is fully and wholly owned by assessee and consequently would not include a residential house owned by more than one person. In the present case, admittedly the house at Sion, Mumbai, was purchased jointly by assessee and his wife. It is nobody’s case that wife is benami of assessee. Therefore, the said house was jointly owned by assessee and his spouse. In view of the discussions made above, it has to be held that assessee was not the owner of a residential house on the date of transfer of original asset. Consequently, the exemption under section 54F could not be denied to assessee”. Going by the conclusions drawn by Mumbai tribunal, you are eligible to exemption u/s 54F. However, the issue is not free from doubt. There is a contrast in the judgment rendered by Hyderabad Tribunal in the case of ITO, Ward-6(3) Vs. Apsara Bhavana Sai (2013) 40 Taxmann 528. Controversy prevails due to divergent views by two tribunals & the issue has not yet reached finality. In view of diverse view by tribunals, your exemption claim could be a matter of dispute & litigation. The revenue may not accept the ratio set out in the case of Rasiklal Satra case. To have an undisputed exemption claim u/s 54F, you can think of other alternatives like gifting of your independent house property or share in a jointly owned house property in favor of other family members prior to selling of your plot/land. [The author is a practicing Chartered Accountant from Nagpur. Readers may send their direct tax related queries at SSRPN & Co, 10, Laxmi Vyankatesh Apartment, C.A. Road, Telephone Exch. Square, Nagpur-440008 or email it at cassrpn@gmail.com or at www.ssrpn.com ]. |

|

.png)